Singapore Mandates DTSP License for All Overseas Digital Token Services

A DTSP license is required for any Singapore-based firms that provide digital token services to customers abroad, or else they are immediately required to cease cross-border activities by the Monetary Authority of Singapore (MAS).

Any Singaporean business, partnership, or person offering digital token services to customers outside of Singapore will be required to do one of the following as of June 30, 2025: Either immediately stop doing business in international markets. Or get a Digital Token Service Provider (DTSP) license under the Financial Services and Markets (FSM) Act 2022.

Stringent Compliance

Nothing may be construed from this order. MAS has made it clear that they will not be providing any kind of extension, grace period, or transitional arrangements. To continue engaging in cross-border digital asset activities, any firm that is subject to these new regulations must comply.

The magnitude of a company’s international operations is irrelevant to the applicability of these regulations. Companies aren’t immune, even if their international clientele only account for a little percentage of their total sales. By addressing this important regulatory gap, MAS is ensuring that crypto firms located in Singapore cannot continue to service consumers worldwide. Especially, who are subject to more stringent regulations in other countries.

Any firm, regardless of size, structure, or direct user engagement, delivering token-related services overseas is considered a DTSP under Singapore’s new regulations. MAS has purposefully broadened the definition. All centralized cryptocurrency exchanges, decentralized financial infrastructures, wallet providers, token issuers, and even non-crypto companies that provide services connected to tokens to customers outside of Singapore fall under this category.

This implies that a Singaporean firm promoting an offshore cryptocurrency project can be deemed a DTSP. Regardless of whether they handle user funds directly or not.

Highlighted Crypto News Today:

Ethereum (ETH) Slumps Below $2,200 Amid Broad Crypto Market Downturn

(责任编辑:ipos)

- ·Top 10 Most Visited Crypto Assets Right Now

- ·Billionaire Ethereum Wallets Now Hold a Third of Supply, Breaking 7

- ·HAKUHODO KEY3's Web3 Global Hackathon 2023: Starts Sept 30

- ·Wall Street Veteran Declares XRP “Is not Just Any Crypto”

- ·Bitcoin(BTC) Raised High After Supply Held by Whale Entities

- ·Shiba Inu Lucie Sends Clear Message: It's Time to Build on Shibarium

- ·US Congress to Scrutinize SEC’s Agenda Amid War Against Crypto

- ·Users Can Now Pay XRP for AirX Flight Booking

- ·Xenon Pay (X2P) Is Ultra

- ·Federal Court Freezes Assets of Former Celsius CEO Alex Mashinsky

- ·Coinbase Enters India, Hires Former Google Pay Executive

- ·Hana Bank & BitGo Partner To Offer Crypto Custody in South Korea

- ·Bitcoin's Price Analysis: Relief Rally on the Horizon?

- ·XRP Eyes Rally Above $0.54 to Pick up Momentum Despite Resistance in Dominance

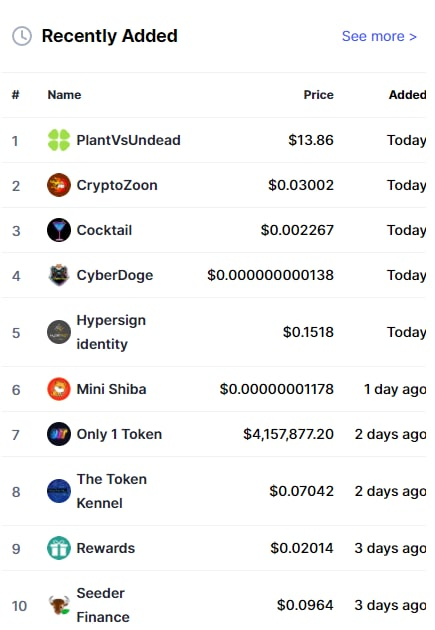

- ·5 Newly Added Crypto: C4G3, BLIZZ, FREE, PKD, BRIGHT

- ·XRP Eyes Rally Above $0.54 to Pick up Momentum Despite Resistance in Dominance

- ·AllianceBlock Unveils Exclusive Collectible Investment Platform

- ·Ripple CEO: We Believe XRP Is Efficient in Many Use Cases, but We Are Not Maximalist

- ·Darma Cash (DMCH) Price Soars Over 250% In Last 24 hours

- ·Shiba Inu Lucie Sends Clear Message: It's Time to Build on Shibarium