Altitude Opens Public Access to Collateral

The DeFi platform for collateral-optimized lending, Altitude, has announced the end of its private beta and is now opening the vaults available to the general public. Consequently, DeFi users may now effectively manage their collateral for lending and borrowing reasons by using Altitude’s automated strategies.

Following a successful beta phase in which whitelisted users tested the lending platform’s features, Altitude is now making it publicly available. After eight months of seamless operation, during which its protocol generated over $5 million in TVL, Altitude is now extending an invitation to the general public to use its platform.

Altitude is intended to provide effective onchain borrowing management in order to guarantee increased capital efficiency and prevent loans from being undercollateralized. With tools for modifying desirable parameters, its dashboard shows each loan’s health depending on LTV. The first DeFi protocol to include rebalancing, Altitude automatically adjusts user borrowing according to the value of collateral like Bitcoin and Ethereum.

Since ordinary DeFi users borrow to an LTV of between 40 and 50 percent, onchain loans are usually capital inefficient, meaning that a significant amount of capital is essentially sitting idle. The increased capital efficiency and the removal of the hassles often connected with borrowing have attracted early adopters of the Altitude beta, allowing them to concentrate on yield production and other DeFi prospects.

When the underlying capital’s value rises, Altitude borrows against it and utilizes the yield produced by the capital to lower the loan amount. Likewise, in order to guarantee the best LTV, Altitude returns funds to the lending pool when the collateral’s value drops. In order to guarantee that customers are funded at the most favorable rate, Altitude’s automated lending and borrowing solution also determines favorable lending rates and modifies positions appropriately.

Altitude was able to secure $6.1 million in investment from a number of top web3 venture capital firms, including Tioga Capital, New Form Capital, and GSR. Altitude’s strategy for providing DeFi borrowers with peace of mind while allowing them to securely create the highest return possible captivated investors.

The next stage of Altitude’s development has begun with the successful completion of the private beta and the public launch of its lending markets. Without having to continuously check positions, DeFi customers may take charge of their lending and borrowing operations by engaging with an easy-to-use user interface. In the middle of a constantly shifting cryptocurrency market, this enables them to generate an alluring yield on their holdings.

Altitude is a decentralized Ethereum protocol that maximizes collateralized lending, guaranteeing the lowest borrowing costs while simultaneously producing yield from users’ idle collateral. Altitude maximizes capital efficiency via real-time, proactive debt and collateral management. Visit https://www.altitude.fi/ to find out more.

(责任编辑:ipos)

- ·Bitcoin Treasury Adoption Replaces Altcoin Speculation Trend: Adam Back

- ·Ripple Sends 200,000,000 XRP to Unknown Wallet: Details

- ·Top Analyst Says Ethereum Comeback to All

- ·Hyperliquid (HYPE) Drops 2.06% as Whale Adds Margin to Avoid Liquidation

- ·Top 3 Memes Tokens by Market Capitalization

- ·Sentient Launches Open Deep Search (ODS), Surpassing Perplexity

- ·Will $10K Worth of Dogecoin Bought in 2025 Be Worth $1M by 2030

- ·Pi Coin Price Approaches All

- ·Stablecoin JPYA Launched on IOST Blockchain

- ·VanEck Executive Reveals Plan for Bitcoin Bonds to Address $14 Trillion US Debt

- ·Finally! WallStreetBets Indulges in Bitcoin (BTC), Ethereum (ETH) and Other Cryptos!

- ·Shiba Inu Team Reveals The Hottest Token on Shibarium

- ·Top Analyst Shares Timeline for XRP to Reclaim Its All

- ·Steady Shiba Inu Investor Acquires Over 237,000 BONE Tokens Through Daily Buys in 3 Years

- ·Crypto Market Crashes Third Time in Two Weeks. Is It a Correction?

- ·74.4% of Binance Traders Hold Long Positions on Dogecoin, Here’s What It Means

- ·Dogecoin Big Move: Top Analyst Says Doge Price Could Surge 137% to $0.3983

- ·Ethena (ENA) Slides Below $0.30 as Bearish Signals Intensify

- ·Why Is XRP Price Up Today?

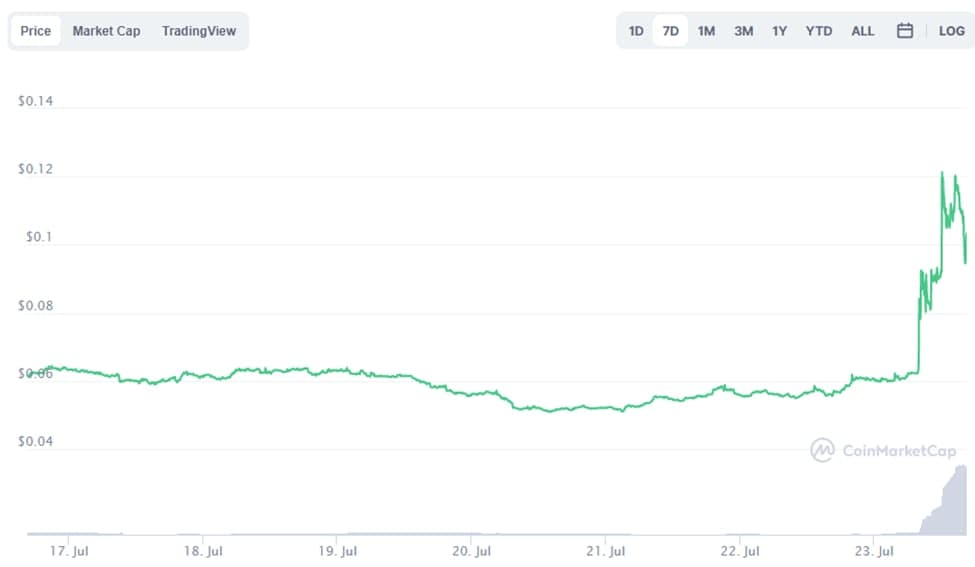

- ·Vine Coin (VINE) Surges 121% in a Single Day Amid Crypto Market Fluctuations